Seamless Shopping: Buy Now with flexible payment plans.

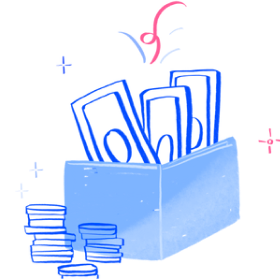

Embrace a new era of financial flexibility with our Pay Small Small plan. It's designed for those who value convenience and affordability.

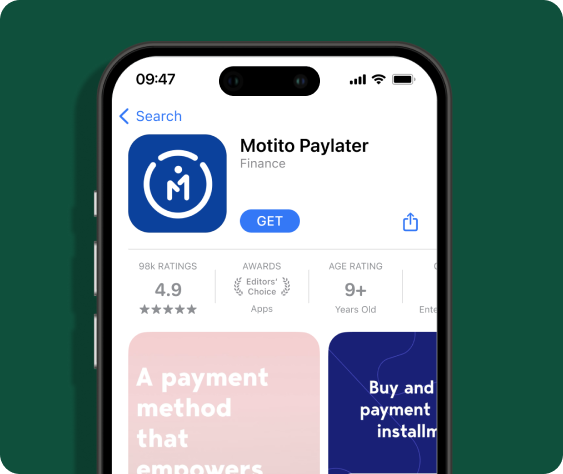

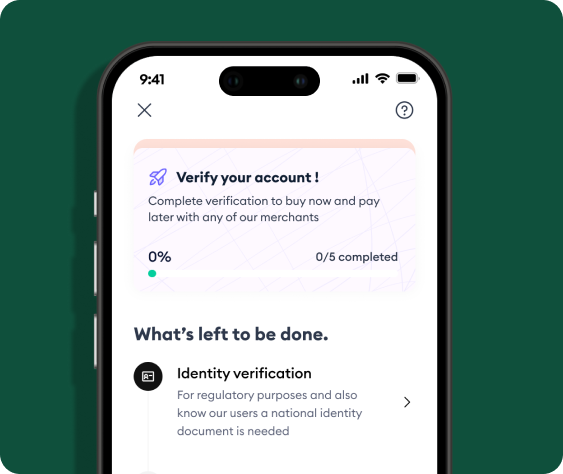

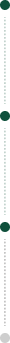

How does Motito Buy Now, Pay Later work?

Show at any of out partnered merchants or shop, find what you love and start paying over time.

Get up to GHS 7,000 asset financing credit.

Buy now, pay later: Make a down payment, take it home, and pay over time with flexible plans from our trusted partners.

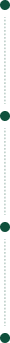

Flexible payment plans to suit you.

Pay for your purchase over time with flexible payment plans that fit your budget.Choose from a variety of payment options.

30 days interest free and no hidden fees

Get 30 days to pay off your purchase without any interest, and there are no hidden fees.

Flexible payments at our partner stores.

shop with any of our partner shops and enjoy instalment payments

Featured stores

xiaomi ghana

Mobile phones & accessories

Ashfoam

Furniture

Electromart

Home Electronic

Trimlyne

Furniture

Buy now Paylater calculator

Change the inputs below to see motito’s monthly payment plan. This can help you plan for your next purchase

Down payment

GHS 1,556.80

(40% of cost of item)

Monthly Instalment

GHS 778.40/ month

Total service charge after interest free period

GHS 392.00

Financing your next asset made easy.

Got questions about paylater?

Get the answers to your questions about motito.

How does Motito's buy now paylater worK?

Motito Buy Now Pay Later (BNPL) service, allowing users to purchase items and pay for them in instalments for greater flexibility and convenience.

Does Motito provide cash loans?

The app does not offer cash loans. It provides the option to purchase items and make payments in instalments.

Are there any fees and charges?

There is a 5.6% monthly service charge on the retail price, with the first 30 days being interest-free.

What are the instalment terms?

At Motito, we understand that everyone's financial situation is different. That's why we offer instalment plans that can be as long as 3 months, with a 30-day interest-free period included for regular plans. For specialised schemes, clients can enjoy up to a 6-month plan.